1.1.3. Recurrent Transactions¶

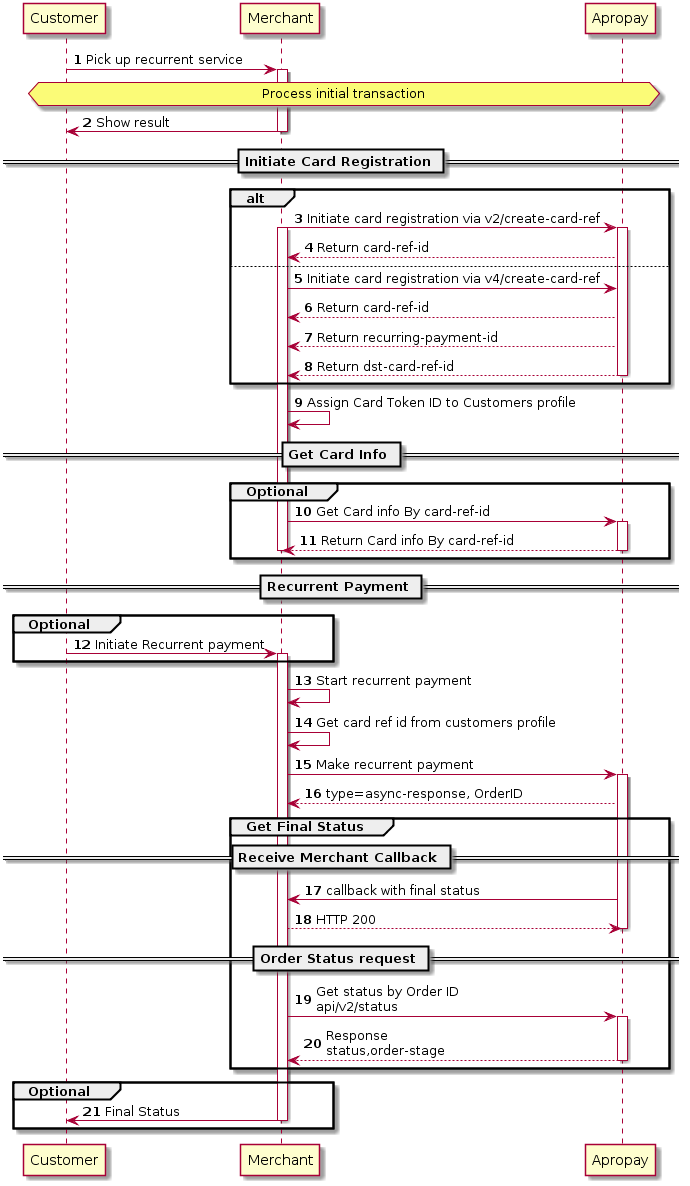

Recurrent Payment General Flow¶

Recurrent payments are made in three steps:

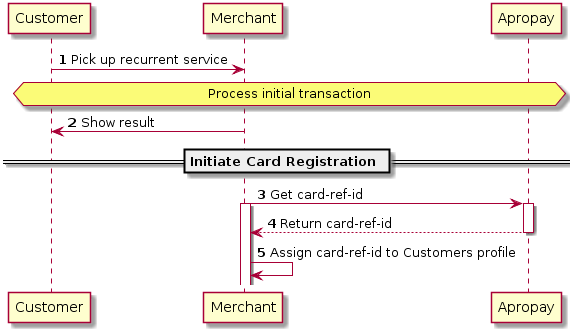

Process Card Registration via v2/create-card-ref¶

Card Registration Diagram¶

Card Registration request URL¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

Card registration request parameters¶

Note

| Registration request Parameter | Description |

|---|---|

| login | Merchant login name. |

| client_orderid | Merchant order identifier of the transaction for which the status is requested. |

| orderid | Order id assigned to the order by Apropay. |

| control | Checksum used to ensure that it is the Merchant (and not a fraudster) who sends the request. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. |

As you may see from the parameters list Merchant has to supply orderid and client_orderid associated with the first payment transaction. It emphasizes that the first payment is a mandatory step to process recurrent payments.

Card Registration Response¶

Note

| Registration Response Parameter | Description |

|---|---|

| type | The type of response. May be create-card-ref-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| status | See Status List for details. |

| card-ref-id | Customer’s tokenized cardholder’s data ID used in subsequent recurrent payments. |

| unq-card-ref-id | Unique customer’s tokenized cardholder’s data ID to each PAN. It can be used by Merchant for loyalty programs or fraud control. |

| serial-number | Unique number assigned by Apropay server to particular request from the Merchant. |

| error-message | If status is declined or error this parameter contains the reason for decline. |

| error-code | The error code is case of declined or error status. |

| end-point-id | Endpoint id used for the transaction. |

Request Example¶

POST /paynet/api/v2/create-card-ref/39915 HTTP/1.1

Host: sandbox.apropay.com

User-Agent: curl/7.83.0

Accept: */*

Content-Length: 107

Content-Type: application/x-www-form-urlencoded

Connection: close

login=ZetMerchant

&client_orderid=34T43R77N

&orderid=6868525

&control=a0c10643aef72cf6612b29fdaea01d74d1071e38

Success Response Example¶

HTTP/1.1 200

Server: server

Date: Thu, 29 Dec 2022 13:35:34 GMT

Content-Type: text/html;charset=utf-8

Connection: close

Vary: Accept-Encoding

X-XSS-Protection: 1

X-Content-Type-Options: nosniff

Strict-Transport-Security: max-age=31536000

Content-Language: en-US

Strict-Transport-Security: max-age=31536000

Content-Length: 144

type=create-card-ref-response

&serial-number=00000000-0000-0000-0000-000002ddfdfe

&card-ref-id=1461618

&unq-card-ref-id=2463777

&status=approved

Fail Response Example¶

HTTP/1.1 200

Server: server

Date: Thu, 29 Dec 2022 13:32:32 GMT

Content-Type: text/html;charset=utf-8

Connection: close

Vary: Accept-Encoding

X-XSS-Protection: 1

X-Content-Type-Options: nosniff

Strict-Transport-Security: max-age=31536000

Content-Language: en-US

Strict-Transport-Security: max-age=31536000

Content-Length: 123

type=validation-error

&serial-number=00000000-0000-0000-0000-000002ddfd9c

&error-message=INVALID_CONTROL_CODE

&error-code=2

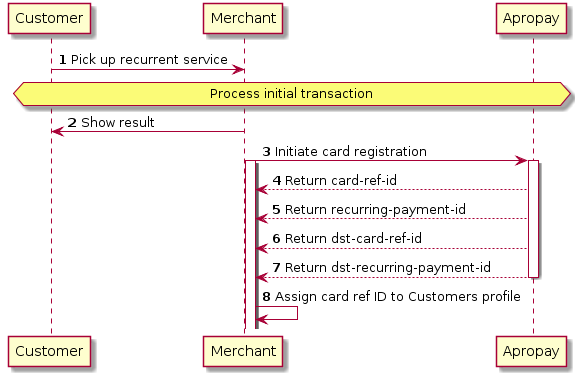

Process Card Registration via v4/create-card-ref¶

Card Registration Diagram¶

Card Registration request URL¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

Card registration request parameters¶

Note

| Registration request Parameter | Description |

|---|---|

| client_orderid | Merchant order identifier of the transaction for which the status is requested. |

| orderid | Order id assigned to the order by Apropay. |

As you may see from the parameters list Merchant has to supply orderid and client_orderid associated with the first payment transaction. It emphasizes that the first payment is a mandatory step to process recurrent payments.

Card Registration Response¶

Note

| Registration Response Parameter | Description |

|---|---|

| type | The type of response. May be create-card-ref-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| status | See Status List for details. |

| card-ref-id | Customer’s tokenized cardholder’s data ID used in subsequent recurring payments. |

| recurring-payment-id | Customer’s tokenized cardholder’s data ID which is used in different set of APIs and also can be used in initiating automate transactions. |

| dst-card-ref-id | Customer’s tokenized cardholder’s data ID. Can be used only in transfer APIs as a destination card. |

| dst-recurring-payment-id | Customer’s tokenized cardholder’s data ID. Can be used only in transfer APIs as a destination card. |

| serial-number | Unique number assigned by Apropay server to particular request from the Merchant. |

| error-message | If status is declined or error this parameter contains the reason for decline. |

| error-code | The error code is case of declined or error status. |

| end-point-id | Endpoint id used for the transaction. |

Card Registration Request Debug¶

Enter your private key in PKCS#1 container to use debug. See OAuth RSA-SHA256 for details.

Debug form

| Normalized parameters string to sign, according to OAuth 1.0a rules |

|---|

| POST body parameters to submit |

|---|

| OAuth 1.0a headers to submit. |

|---|

| HEX Encoded Signature |

|---|

| Base64 Encoded Signature |

|---|

|

Request Example¶

POST /paynet/api/v4/create-card-ref/39915 HTTP/1.1

Host: sandbox.apropay.com

User-Agent: curl/7.83.0

Accept: */*

Authorization: OAuth oauth_consumer_key="ZetMerchant", oauth_nonce="KT6cZmuVGqg0V6Jm2RE3q4o79KXC1v2q", oauth_signature="KucF0eYk3WZCV7oKwOi1z6PR%2BkHxiZwPucD6Sx%2BX2mV%2BbaidPy9K9USh8ciMKM60NNl1LYYjywdaErB1uTIdFFbQ8ZKs8M1smaMPOaHDaApceTOlDh6E7u3BzBTKYhBc%2BWnksZz9Wyz8%2B39lHCIODo0KZmNmXCTjjZmlx%2FrFNkK%2FhwJV9Kwq1nPbA5QZTkF686O0O0lHFy3Prx649AIRgsrqDLb5%2FgHL9M8fSScVUPnGdLGJ2hSgKJFpIOFibT0nC89Xg8odn1hR9WIa1650glaqZntSkocBzXAkOKa7kIbSOZW1sFCiBjksy6o1sny9hmc%2F9cC9t86RoEY1QhVYuvOLztQm1dLhpRy%2FPOL9LCmIzO3B%2FUB2wJUXPkEyFsSLZVeqQl%2B0IukljV6Cr1ZfuyUktbvvXJsnod5AK%2FsV2GaxEf%2BttqqWv%2FFNjPLoUZYrPB6rKsIpw%2FOftinIwIxYzLY3FMmbKQd6zxnMJLJm7M2s6cQFGiAnfgvZFAMZhugBuuigy4T9Ckq1t5N9vQkl2htDv0TTnswx50wpF%2F7OKiXTVFNqOE%2FCj%2F07ZwZbxbD%2FMxKhOhfNMME1jGxzgI0wEj1166eKpxnCOk%2BTlYTJvNW5%2BbKuGnU43Q2Nmga0aQ007NKRfIV%2FWk6e%2BUuGO48wGdi0CiKxS9hpnpvjyPLc%2BsA%3D", oauth_signature_method="RSA-SHA256", oauth_timestamp="1673335450", oauth_version="1.0"

Content-Length: 40

Content-Type: application/x-www-form-urlencoded

Connection: close

client_orderid=34T43R77N

&orderid=6868305

Success Response Example¶

HTTP/1.1 200

Server: server

Date: Tue, 10 Jan 2023 07:24:36 GMT

Content-Type: text/html;charset=utf-8

Connection: close

Vary: Accept-Encoding

X-XSS-Protection: 1

X-Content-Type-Options: nosniff

Strict-Transport-Security: max-age=31536000

Content-Language: en-US

Strict-Transport-Security: max-age=31536000

Content-Length: 174

type=create-card-ref-response

&serial-number=00000000-0000-0000-0000-000002de3113

&card-ref-id=1461608

&recurring-payment-id=1491863

&dst-card-ref-id=1461608

&status=approved

Fail Response Example¶

HTTP/1.1 403

Server: server

Date: Tue, 10 Jan 2023 07:34:08 GMT

Content-Type: text/html

Content-Length: 735

Connection: close

X-XSS-Protection: 1

X-Content-Type-Options: nosniff

Strict-Transport-Security: max-age=31536000

<!DOCTYPE html>

<html>

<head>

<meta http-equiv="Content-Type" content="text/html; charset=utf-8"/>

<title>403</title>

<style type="text/css">

body {

font-family: Arial, sans-serif;

font-size: 130%;

background-color: #eee;

}

p {

margin: 10em auto 0;

width: 500px;

border: 1px solid gray;

text-align: center;

vertical-align: middle;

padding: 40px 20px;

background-color: #fff;

-webkit-border-radius: 20px;

-moz-border-radius: 20px;

border-radius: 20px;

}

</style>

</head>

<body>

<p>Access is denied</p>

</body>

</html>

Get Cardholder details with Card Reference Identifier¶

Cardholder details request URL¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

https://gate.apropay.com/paynet/api/v2/get-card-info/ENDPOINTID

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

https://gate.apropay.com/paynet/api/v2/get-card-info/group/ENDPOINTGROUPID

Card Information request parameters¶

Note

| Information request Parameter | Length/Type | Comment | Necessity* |

|---|---|---|---|

| login | 20/String | Merchant login name. | Mandatory |

| cardrefid | 20/String | Equals to card-ref-id obtained in card information reference id call during Card Registration stage. | Mandatory |

| control | 128/String | Checksum used to ensure that it is Merchant (and not a fraudster) that initiates the return request. This is SHA-1 checksum of the concatenation login + cardrefid + merchant_control. | Mandatory |

Get Card Information Response¶

Note

| Information Response Parameter | Description |

|---|---|

| type | The type of response. May be get-card-info-response, validation-error, error. If type equals error, error-message and error-code parameters contain error details. |

| card-printed-name | Card holder name. |

| expire-year | Card expiration year. |

| expire-month | Card expiration month. |

| bin | Bank Identification Number. |

| last-four-digits | The last four digits of PAN. |

| serial-number | Unique number assigned by Apropay server to particular request from the Merchant. |

| error-message | If status is validation-error or error this parameter contains the reason for decline or error details. |

| error-code | The error code is case of validation-error or error status. |

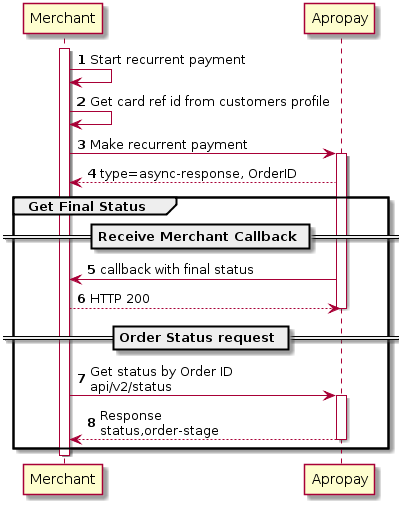

Process Recurrent Payment¶

Successful Recurrent Payment Diagram¶

Recurrent Payment request URL¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

Recurrent Payment request parameters¶

Note

| Payment request parameter | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| login | 20/String | Merchant’s login. | Mandatory |

| cardrefid | 20/String | Card reference id obtained at Card Registration step. | Mandatory |

| order_desc | 64k/String | Order description. | Mandatory |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. For instance, 10.5 for USD means 10 US Dollars and 50 Cents. | Mandatory |

| enumerate_amounts | 128/String | This parameter may comprise multiple amounts, separated with ,. Apropay will cycle through the amounts of the list, try to make a payment on that amount, until there are no more amounts from the list, or not get approved. | Optional |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Example ofВ valid parameter values are: USD for US Dollar EUR for European Euro. | Mandatory |

| cvv2 | 3-4/Numeric | Customer’s CVV2 code. CVV2 (Card Verification Value) is a three- or four-digit number AFTER the credit card number in the signature area of the card. May be empty or absent if bank gateway supports processing without CVV2. | Optional |

| ipaddress | 45/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| control | 40/String | Checksum generated by SHA-1. This is SHA-1 checksum of the concatenation login + client_orderid + cardrefid + amount_in_cents + currency + merchant_control. | Mandatory |

| comment | 50/String | A short comment. | Optional |

| purpose | 128/String | Destination to where the payment goes. It is useful for the merchants who let their clients to transfer money from a credit card to some type of client’s account, e.g. game or mobile phone account. Sample values are: +7123456789; gamer0001@ereality.com etc. This value will be used by fraud monitoring system. | Optional |

| redirect_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from Apropay gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Parameter is mandatory for 3DS flow and optional for non-3DS. Pass http://google.com if you are not sure. | Optional |

| redirect_success_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected only in case if the transaction is approved. You should not use this parameter to retrieve results from Apropay gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Pass http://google.com if you use non-3DS schema for transactions processing and you have no need to return customer anywhere. | Optional |

| redirect_fail_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected only in case if the transaction is declined or filtered. You should not use this parameter to retrieve results from Apropay gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Pass http://google.com if you use non-3DS schema for transactions processing and you have no need to return customer anywhere. | Optional |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks. | Optional |

| merchant_data | 64k/String | Any additional information for this transaction which may be useful in Merchant’s external systems, e.g. VIP customer, TV promo campaign lead. Will be returned in Status response and Merchant Callback. | Optional |

| recurrent_scenario | 50/String | Type of the rebill transaction. Possible values: REGULAR or IRREGULAR. If this parameter is sent in the request, it will have priority over the same parameter specified on gate level. Only used for specific acquirers. | Optional |

| recurrent_initiator | 50/String | Initiator of the rebill transaction. Possible values: CARDHOLDER or MERCHANT. If this parameter is sent in the request, it will have priority over the same parameter specified on gate level. Only used for specific acquirers. | Optional |

Recurrent Response¶

Note

| Recurrent Response Parameter | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| paynet-order-id | Order id assigned to the order by Apropay. |

| merchant-order-id | Merchant order id. |

| serial-number | Unique number assigned by Apropay server to particular request from the Merchant. |

| error-message | If status is error this parameter contains the reason for decline or error details. |

| error-code | The error code is case of error status. |

Recurrent request authorization through control parameter¶

The checksum is used to ensure that it is a particular Merchant (and not a fraudster) that initiates the transaction. This SHA-1 checksum, the parameter control, is created by concatenation of the parameters’ values in the following order:

- ENDPOINTID/ENDPOINTGROUPID

- login

- client_orderid

- cardrefid

- minimal monetary units amount (i.e. cent, penny etc. For amount 0.94 USD value in signing string will be 94, for 10.15 USD value in signing string will be 1015)

- currency

- merchant_control

A complete string example may look as follows:

logic902B4FF550703500EURB17F59B4-A7DC-41B4-8FF9-37D986B43D20

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter (see Sale Request Parameters) which is required for request authorization. For the above-mentioned example the control will take the following value:

9d7370ef6d3c632f2a3b50c4a07041d87e27bbf8

Recurrent Response Example¶

type=async-response

&serial-number=00000000-0000-0000-0000-0000000624e8

&merchant-order-id=59e1e3ca-5d44-11e1-b3d6-002522b853b4

&paynet-order-id=94935

Order status¶

Merchant must use Order Status API call to get the customer’s order transaction status. After any type of transaction is sent to Apropay server and order id is returned, Merchant should poll for transaction status. When transaction is processed on Apropay server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

For integration purposes use staging environment sandbox.apropay.com instead of production gate.apropay.com. Status API calls are initiated through HTTPS POST request by using URL in the following format:

Order status call parameters¶

Note

| Status Request Parameter | Description |

|---|---|

| login | Merchant login name. |

| client_orderid | Merchant order identifier of the transaction for which the status is requested. |

| orderid | Order id assigned to the order by Apropay. |

| by-request-sn | Serial number assigned to the specific request by Apropay. If this field exist in status request, status response return for this specific request. |

| control | Checksum used to ensure that it is Apropay (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order Status API call authorization through control parameter for more details about generating control checksum. |

Order Status Response¶

Note

| Status Response Parameter | Description |

|---|---|

| type | The type of response. May be status-response. |

| status | See Status List for details. |

| amount | Amount of the initial transaction. |

| currency | Currency of the initial transaction. |

| paynet-order-id | Order id assigned to the order by Apropay. |

| merchant-order-id | Merchant order id. |

| phone | Customer phone. |

| serial-number | Unique number assigned by Apropay server to particular request from the Merchant. |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card number. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| transaction-type | Transaction type (sale, reversal, capture, preauth). |

| processor-rrn | Bank Receiver Registration Number. |

| processor-tx-id | Acquirer transaction identifier. |

| receipt-id | Electronic link to receipt https://gate.apropay.com/paynet/view-receipt/ENDPOINTID/receipt-id/. |

| name | Cardholder name. |

| cardholder-name | Cardholder name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| card-country-alpha-three-code | Three letter country code of source card issuer. See Country Codes for details. |

| destination-card-country-alpha-three-code | Three letter country code of destination card issuer. See Country Codes for details. |

| Customer e-mail. | |

| first-name | Customer’s first name. |

| last-name | Customer’s last name. |

| country * | Customer’s country (two-letter country code). Please see Country Codes for a list of valid country codes. |

| state * | Customer’s state . Please see Country Codes for a list of valid state codes. Mandatory for USA, Canada and Australia. |

| city * | Customer’s city. |

| zip_code * | Customer’s ZIP code. |

| address1 * | Customer’s address line 1. |

| bank-name | Bank name by customer card BIN. |

| terminal-id | Acquirer terminal identifier to show in receipt. |

| paynet-processing-date | Acquirer transaction processing date. |

| approval-code | Bank approval code. |

| order-stage | The current stage of the transaction processing. See Order Stage for details. |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available. |

| loyalty-message | The message from the loyalty program. if available. |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available. |

| loyalty-program | The name of the loyalty program for current operation. if available. |

| descriptor | Bank identifier of the payment recipient. |

| original-gate-descriptor | Descriptor, which is set on gate level in the system. |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline. |

| error-code | The error code is case status in declined, error, filtered. |

| by-request-sn | Serial number from status request, if exists in request. Warning parameter amount always shows initial transaction amount, even if status is requested by-request-sn. |

| verified-3d-status | See 3-D Secure Status List for details. |

| eci | Electronic Commerce Indicator (Visa). |

| ips-src-payment-product-code | Code for card set by multinational financial service. (Visa/Mastercard) |

| ips-src-payment-product-name | Decrypted code for card set by multinational financial service. (Visa/Mastercard) |

| ips-src-payment-type-code | Type of card code set by multinational financial service. (Visa/Mastercard) |

| ips-src-payment-type-name | Decrypted code for type of card set by multinational financial service. (Visa/Mastercard) |

| merchantdata | If provided in initial request, merchant_data parameter and its value will be included in status response. |

| initial-amount | Amount, set in initiating transaction, without any fees or commissions. This value can’t change during the transaction flow. |

| seller-commission | Total commission for processed transaction. This is optional parameter. Please contact your manager in Apropay, if you would like to receive it. |

| acquirer-commission | Acquirer commission for processed transaction. This is optional parameter. Please contact your manager in Apropay, if you would like to receive it. |

| motivational-message | This is an optional message which contains extended information about the reason for the declined transaction. |

| transaction-date | Date of final status assignment for transaction. |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-00000aa68276

&merchant-order-id=pg1sbw

&processor-tx-id=15222817

&paynet-order-id=15222817

&status=approved

&amount=20000.00

&descriptor=no

&original-gate-descriptor=test 12345678 3Ds Bank

&transaction-type=sale

&receipt-id=18042926-d652-331c-b5a0-3e1dbacf69b2

&name=HOLDER

&cardholder-name=HOLDER

&card-exp-month=3

&card-exp-year=2016

&email=gmail.com

&last-name=Smith

&first-name=John

&processor-rrn=187722741

&approval-code=610669

&order-stage=sale_approved

&last-four-digits=7682

&bin=427655

&card-type=VISA

&phone=%2B79633014273

&bank-name=SBERBANK

&paynet-processing-date=2015-04-06+22%3A00%3A27+MSK

&by-request-sn=00000000-0000-0000-0000-00000a8d3992

&card-hash-id=1664889

&card-country-alpha-three-code=RUS

&verified-3d-status=AUTHENTICATED

&eci=02

&ips-src-payment-product-code=SAP

&ips-src-payment-product-name=SAP—Platinum Mastercard® Salary– Immediate Debit

&ips-src-payment-type-code=Debit

&ips-src-payment-type-name=MASTERCARD Debit

&merchantdata=promo

&initial-amount=20000.00

&transaction-date=2023-01-10+12%3A46%3A28+MSK

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to Apropay. This SHA-1 checksum, the parameter control, is created by concatenation of these parameters values in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example, assume these parameters have the values as listed below:

| Parameter Name | Parameter Value |

|---|---|

| login | cool_merchant |

| client_orderid | 5624444333322221111110 |

| orderid | 9625 |

| merchant_control | r45a019070772d1c4c2b503bbdc0fa22 |

The complete string example may look as follows:

cool_merchant56244443333222211111109625r45a019070772d1c4c2b503bbdc0fa22

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

c52cfb609f20a3677eb280cc4709278ea8f7024c