3.1. Merchant Callbacks¶

When ENDPOINT is created for Merchant’s website callback URLs might be defined for any type of transaction type and transaction status.

These callback URLs will be called when the transaction is completed, whether approved, declined or reaching error or unknown state. This gives a Merchant better control how the transaction is processed on Merchant’s side, for example to add appropriate records to Merchant’s internal accounting system.

Please remember, callbacks are guaranteed to report merchant about transaction status. Merchants on their side must provide a means of preventing receiving the same callback twice - in case of network or other technical problems. It is recommended to check status, type, orderid and client_orderid to prevent duplication of transactions on merchant side.

3.1.1. Callback simple URL¶

If you want to make sure that the customer has paid for the item, you should specify a callback URL. If you do, Apropay sends an HTTP GET message to the callback URL whenever a purchase completed, no matter if the result is approved or declined. Your server needs to answer this GET message 200 OK status RFC, or else Apropay will continue to send the callback 30 times for 14 days applying the progressive timeline. Simple form of Sale or Return callback is just an URL to Merchant’s target page or script without any parameters, for example: https://www.i-cool-merchant.com/sale.php.

You can use only following ports in callback URL: * for HTTP 80, 8080 * for HTTPS 443, 8443

In this case the system automatically adds the following parameters to callback URL.

Also there is a notify_url parameter, which can be used instead of server_callback_url parameter if you want to receive every notification when transaction receives one of the new Types of Transactions, for example reversal or chargeback. In this case there is no need to set callback url manually at the endpoint level for each transaction type.

Callback Parameters¶

| Apropay Callback Parameter | Description |

|---|---|

| status | See Status List for details. |

| merchant_order | Merchant order identifier, client_orderid |

| client_orderid | Merchant order identifier |

| orderid | Apropay transaction id |

| type | Transaction type, sale reversal chargeback |

| amount | Actual transaction amount. This value can be changed during the transaction flow. |

| currency | Transaction currency |

| descriptor | Payment descriptor of the gate through which the transaction has been processed. |

| original-gate-descriptor | Descriptor, which is set on gate level in the system. |

| error_code | Error Code |

| error_message | Error Message |

| name | Cardholder Name |

| Customer’s email | |

| first-name | Customer’s first name |

| last-name | Customer’s last name |

| country * | Customer’s country (two-letter country code). Please see Country Codes for a list of valid country codes. |

| state * | Customer’s state . Please see Country Codes for a list of valid state codes. Mandatory for USA, Canada and Australia. |

| city * | Customer’s city |

| zip_code * | Customer’s ZIP code |

| address1 * | Customer’s address line 1 |

| approval-code | Authorization approval code, if any |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| phone | Customer phone number. |

| bank-name | Customer bank name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| reason-code | Reason code for chargeback or fraud operation. |

| processor-rrn | Bank Retrieval Reference Number. |

| comment | Comment in case of Return transaction |

| rapida-balance | Current balance for merchants registered in Rapida system (only if balance check active) |

| control | Checksum is used to ensure that it is Apropay (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation status + orderid + merchant_order + merchant_control. The callback script MUST check this parameter by comparing it to SHA-1 checksum of the above concatenation. See Callback authorization through control parameter for more details about generating control checksum. |

| merchantdata | The value passed by merchant in initial request. |

| serial-number | Serial number of the request. |

| processor-tx-id | Transaction id set by processor. |

| processor-auth-credit-code | Reserved |

| card-hash-id | Unique hash of the particular card, does not change. |

| verified-3d-status | Will return AUTHENTICATED if a transaction was approved by 3DS. |

| processor-credit-rrn | Retrieval Reference Number set by acquirer. |

| processor-credit-arn | Acquirer card reference number for credit card. |

| processor-debit-arn | Acquirer card reference number for debit card. |

| eci | Electronic Commerce Indicator (Visa). |

| ips-src-payment-product-code | Code for card set by multinational financial service. (Visa/Mastercard). |

| ips-src-payment-product-name | Decrypted code for card set by multinational financial service. (Visa/Mastercard). |

| ips-src-payment-type-code | Type of card code set by multinational financial service. (Visa/Mastercard). |

| ips-src-payment-type-name | Decrypted code for type of card set by multinational financial service. (Visa/Mastercard) |

| card-country-alpha-three-code | Three letter country code of source card issuer. See Country Codes for details |

| destination-card-country-alpha-three-code | Three letter country code of destination card issuer. See Country Codes for details |

| initial-amount | Amount, set in initiating transaction, without any fees or commissions. This value can’t change during the transaction flow. |

| seller-commission | Total commission for processed transaction. This is optional parameter. Please contact your manager in Apropay, if you would like to receive it. |

| acquirer-commission | Acquirer commission for processed transaction. This is optional parameter. Please contact your manager in Apropay, if you would like to receive it. |

| exchange-rate | Basic exchange rate for currency conversion. |

| effective-exchange-rate | Actual exchange rate, applied during currency conversion. |

| transaction-date | Time and date of transaction’s final status. |

| motivational-message | This is an optional message which contains extended information about the reason for the declined transaction. |

| orig-amount | Contains the original request amount if it was converted on auxiliary endpoint in Parallel form integration. |

| orig-currency | Contains the original request currency if it was converted on auxiliary endpoint in Parallel form integration. |

Note

3.1.2. Сustomizable callback URL¶

Customizable callback URL is a fully defined URL with all the parameters Merchant’s target page or script would require. Customizable URL allows defining Merchant’s own parameter names, whereas the actual parameters values are defined by use of macros with the following format ${parameter_name}. Thus Apropay substitutes respective parameter values into final customized URL before calling it.

Example:

https://www.i-cool-merchant.com/sale_completed.php?cardholder_name= ${name}&tx_status=${status}&order_id=${merchant_order}

Callback Macros¶

| Apropay Callback Macros name | Description |

|---|---|

| ${status} | Transaction status, approved declined processing |

| ${merchant_order} | Merchant order identifier, client_orderid |

| ${orderid} | Apropay transaction id |

| ${type} | Transaction type, sale return chargeback |

| ${amount} | Transaction amount |

| ${descriptor} | Payment descriptor of the gate through which the transaction has been processed. |

| ${error_message} | Error message: when ${status} meaning declined |

| ${name} | Cardholder Name |

| ${email} | Customer’s email |

| ${last-four-digits} | Last four digits of customer credit card number. |

| ${bin} | Bank BIN of customer credit card. |

| ${card-type} | Type of customer credit card (VISA, MASTERCARD, etc). |

| ${card-exp-month} | Card expiration month. |

| ${card-exp-year} | Card expiration year. |

| ${gate-partial-reversal} | Processing gate support partial reversal (enabled or disabled). |

| ${gate-partial-capture} | Processing gate support partial capture (enabled or disabled). |

| ${reason-code} | Reason code for chargebak or fraud operation. |

| ${processor-rrn} | Bank Retrieval Reference Number. |

| ${approval-code} | Bank approval code. |

| ${comment} | Comment in case of Return transaction |

| ${rapida-balance} | Current balance for merchants registered in Rapida system (only if balance check active) |

| ${control} | Checksum is used to ensure that it is Apropay (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation status + orderid + merchant_order + merchant_control. The callback script MUST check this parameter by comparing it to SHA-1 checksum of the above concatenation. See Callback authorization through control parameter for more details about generating control checksum. |

| ${merchantdata} | The value passed by merchant in initial request. |

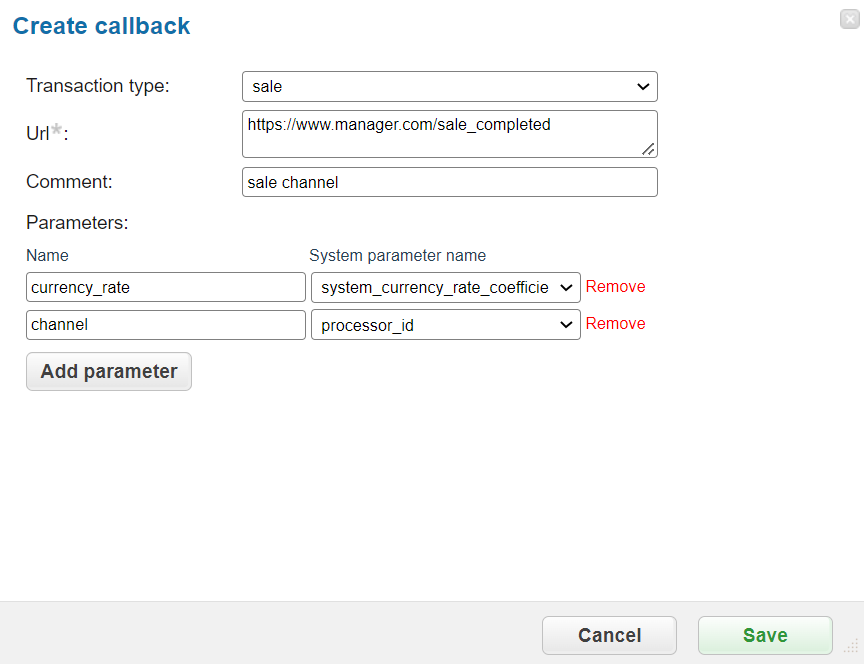

3.1.3. Additional callback for manager¶

Additional callback can be configured at the endpoint level by using Create Callback utility. To set up new callback, click the “Add Callback” button. There are several parameters can be defined in the window:

- Transaction type

- URL address - is the fully defined URL with all the parameters Manager’s target page or script would require. Example: https://www.manager.com/sale_completed

- Comment if it is required

- Name and System Parameters. Name - is the manually specified parameter name to be sent in callback, System Parameters - is the one of the selected system parameter values.

The table below describes the callback system parameters.

| Callback parameter name | Comment |

|---|---|

| endpoint_id | ID of the used endpoint |

| gate_id | ID of the used gate |

| manager_id | ID of the manager |

| merchant_id | ID of the merchant |

| processor_id | ID of the used processor |

| project_id | ID of the project |

| system_currency_rate_coefficient_on_gate | Currency conversion rate used in processing of this transaction |

3.1.4. Callback authorization through control parameter¶

The checksum is used to ensure that the callback is sent to the merchant by Apropay, and not by a fraudster. WARNING! If Merchant does not check the “control” parameter in the callback script, a fraudster might use the callback URL to carry out fraudulent activities on the Merchant’s system. This SHA-1 checksum (the “control” parameter) is created by concatenation of the parameters’ values in the following order:

- status

- orderid

- merchant_order

- merchant_control_key

The complete string example may look as follows:

approved123invoice-1AF4B5DE6-3468-424C-A922-C1DAD7CB4509

Encrypt the string using SHA-1 algorithm. The resultant string yields the “control” parameter which is required for authorizing the callback. For the example the “control” above will take the following value:

5bc8ee48f9ba37c0fd1e0b052a9bc105c6df87e1

3.1.5. Callback to Status Parameters Mapping¶

The following table contains a correspondence between callback parameters and status response fields.

| Callback parameter Name | Status parameter Name |

|---|---|

| amount | amount |

| approval-code | approval-code |

| bin | bin |

| card-type | card-type |

| last-four-digits | last-four-digits |

| bank-name | bank-name |

| name | name |

| first-name | first-name |

| last-name | last-name |

| country | country |

| state | state |

| city | city |

| zip_code | zip_code |

| address1 | address1 |

| card-exp-month | card-exp-month |

| card-exp-year | card-exp-year |

| client_orderid | merchant-order-id |

| comment | comment |

| descriptor | descriptor |

| dest-bin | dest-bin |

| dest-card-type | dest-card-type |

| dest-last-four-digits | dest-last-four-digits |

| dest-bank-name | dest-bank-name |

| purpose | purpose |

| error_code | error-code |

| error_message | error-message |

| gate-partial-capture | gate-partial-capture |

| gate-partial-reversal | gate-partial-reversal |

| loyalty-balance | loyalty-balance |

| loyalty-bonus | loyalty-bonus |

| loyalty-message | loyalty-message |

| loyalty-program | loyalty-program |

| merchant_order | merchant-order-id |

| merchantdata | merchantdata |

| orderid | paynet-order-id |

| original-gate-descriptor | original-gate-descriptor |

| phone | phone |

| processor-rrn | processor-rrn |

| processor-tx-id | processor-tx-id |

| rapida-balance | rapida-balance |

| reason-code | reason-code |

| serial-number | serial-number |

| status | status |

| type | transaction-type |

| initial-amount | initial-amount |

| seller-commission | seller-commission |

| acquirer-commission | acquirer-commission |

| exchange-rate | exchange-rate |

| effective-exchange-rate | effective-exchange-rate |

| card-country-alpha-three-code | card-country-alpha-three-code |

| destination-card-country-alpha-three-code | destination-card-country-alpha-three-code |

3.1.6. Callback Signature check example on Java¶

You may see an example how to check the callback signature using JAVA programming language below:

import org.junit.Test;

import java.nio.charset.StandardCharsets;

import java.security.MessageDigest;

import java.security.NoSuchAlgorithmException;

import static org.junit.Assert.assertEquals;

public class TestCallbackSignatureExampleTest {

@Test

public void test() {

String digest3 = calculateCallbackSignature("approved", 123, "invoice-1", "AF4B5DE6-3468-424C-A922-C1DAD7CB4509");

assertEquals("5bc8ee48f9ba37c0fd1e0b052a9bc105c6df87e1", digest3);

}

public String calculateCallbackSignature(String aTransactionStatus, long aOrderId, String aMerchantOrderId, String aMerchantControlKey) {

String text = aTransactionStatus + aOrderId + aMerchantOrderId + aMerchantControlKey;

byte[] buffer = text.getBytes(StandardCharsets.UTF_8);

byte[] shaSum = sha(buffer);

return toHexString(shaSum);

}

/**

* Calculates the SHA-1 digest and returns the value as a <code>byte[]</code>.

*

* @param data

* Data to digest

* @return SHA-1 digest

*/

private static byte[] sha(byte[] data) {

try {

MessageDigest digest = MessageDigest.getInstance("SHA");

return digest.digest(data);

} catch (NoSuchAlgorithmException e) {

throw new IllegalStateException("Couldn't calculate SHA-1 digest", e);

}

}

/**

* Converts bytes to hex string

*/

private static String toHexString(byte[] data) {

StringBuilder sb = new StringBuilder();

for (byte b : data) {

String hex = Integer.toHexString(0xff & b);

if (hex.length() == 1) {

sb.append('0');

}

sb.append(hex);

}

return sb.toString();

}

}